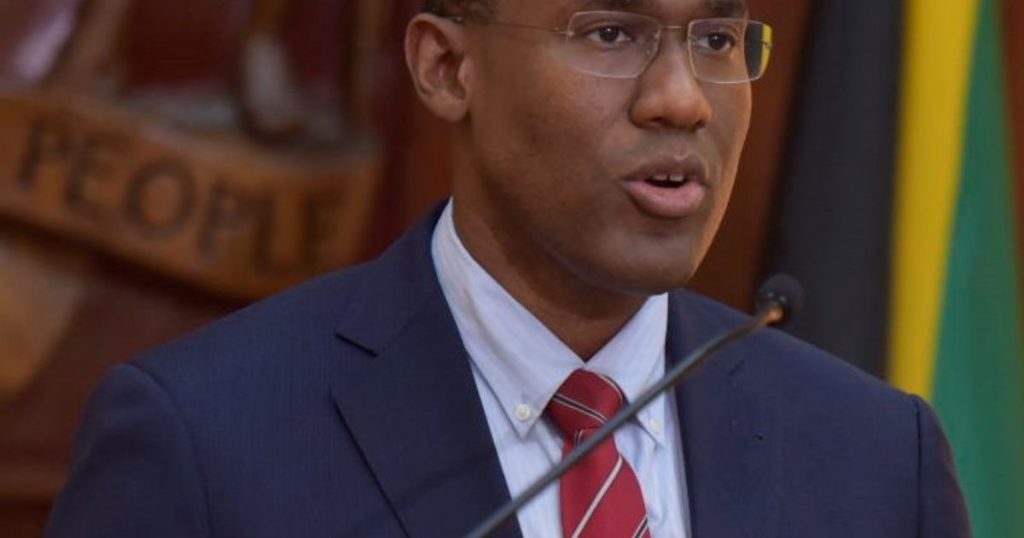

Finance Minister Dr Nigel Clarke has announced an ambitious plan for the rollout of a Central Bank-backed digital currency in Jamaica.

The digital currency would enable people to store value and buy goods and services without the need for actual cash. All that would be required is a cellphone.

“You are going to be able to pay for sky juice with your phone. The pan chicken man will be able to get paid with digital currency on his phone that he will be able to use to buy school books at the store. The potential exists for the NIS pensioner to not have to join a long line at the post office. She will be able to receive her NIS pension on her phone and use it to buy goods as she pleases,”

Clarke said as he opened the 2021-2022 Budget Debate in Parliament on Tuesday.

The minister said that the creation of the digital currency will bring the benefits of financial inclusion to tens of thousands of Jamaicans, many of whom do not have bank accounts.

“With the Central Bank digital currency, more people will be included in the financial system. It will allow for more innovation in the financial services and will provide the foundation for the digital transformation of the economy,”

Clarke said.

He told parliament that a pilot for the use of digital currency will take place this year. It is expected to end in December 2021 with a roll out in early 2022.